Apple has just introduced a new feature called “Apple Pay Later,” and it’s going to change the way we pay for things forever!

Starting today, randomly selected users will be invited to get early access to a prerelease version of Apple Pay Later via Wallet and through their Apple ID email. Apple Pay Later is available in the U.S. for online and in-app purchases on iPhone and iPad. Apple Pay Later is available with iOS 16.4 and iPadOS 16.4.

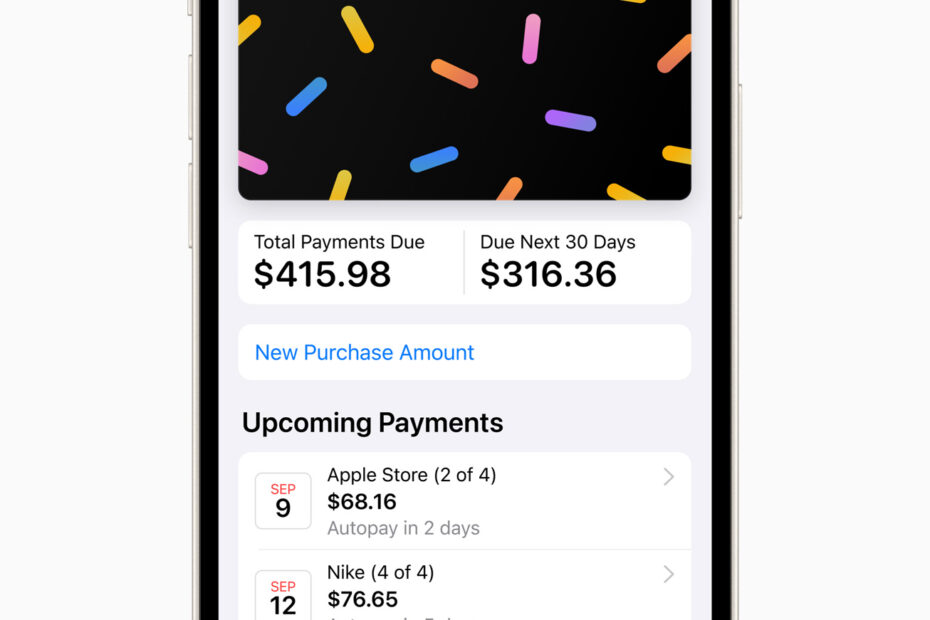

Say you want to buy something pricey, like a new laptop or a fancy bike, but you don’t have all the funds upfront. No problem! With Apple Pay Later, you can split the payment into smaller, more manageable chunks over time. And if you need a little extra time to pay, you can choose to pay later, interest-free!

Apple Pay Later is not the only player in the “buy now, pay later” game. Other companies like Klarna, Afterpay, and Affirm also offer similar services.

But here’s where Apple Pay Later really shines: it’s integrated right into the Apple ecosystem. That means you don’t need to download a separate app or sign up for a new service – it’s all built right into your existing Apple Pay account. Plus, with Apple’s reputation for security and privacy, you can rest easy knowing your financial information is safe and secure.

Additionally, Apple Pay Later offers a range of payment options that competitors may not offer. For example, with Apple Pay Later, you can choose to pay later interest-free, or set up a personalized payment plan that works for you. These features give you more flexibility and control over how you pay for your purchases.

So while other companies may offer similar services, Apple Pay Later’s integration with the Apple ecosystem, reputation for security make it a standout in the buy now, pay later space.

It’s not all rainbows and unicorns in the world of buy-now, pay-later. There are some downsides and controversies to be aware of.

One of the biggest criticisms of buy-now, pay-later services is that they can encourage people to spend beyond their means. With the option to split payments into smaller chunks or delay payment, it’s easy to lose track of how much you’re actually spending. This can lead to overspending, debt, and financial instability.

Another downside is that some buy-now, pay-later services charge high fees and interest rates. While Apple Pay Later doesn’t charge interest, other services can charge anywhere from 10-30% APR, which can quickly add up if you don’t pay off your balance quickly.

There are also concerns about the impact of buy-now, pay-later on credit scores. While some services don’t require a credit check, others do, and missed payments or defaults can hurt your credit score.

Finally, there are also ethical concerns around the marketing and targeting of buy-now, pay-later services to vulnerable populations, such as young people or those with low income.

So while buy-now, pay-later services like Apple Pay Later can be a convenient and flexible way to pay for purchases, it’s important to be aware of the potential downsides and controversies and to use these services responsibly.